PPT - Capital Structure Valuation and Capital Budgeting with Debt PowerPoint Presentation - ID:4686737

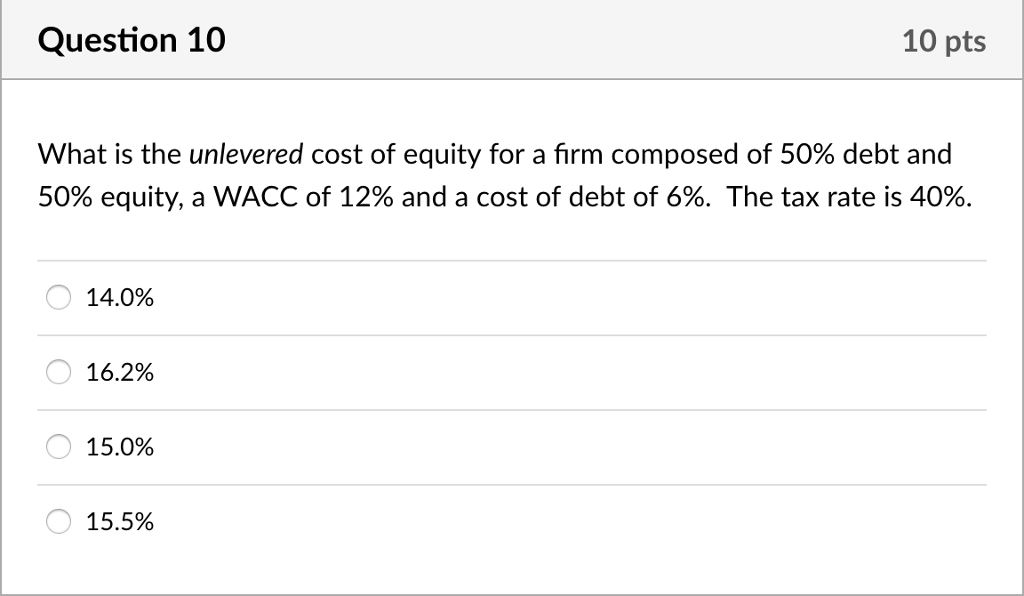

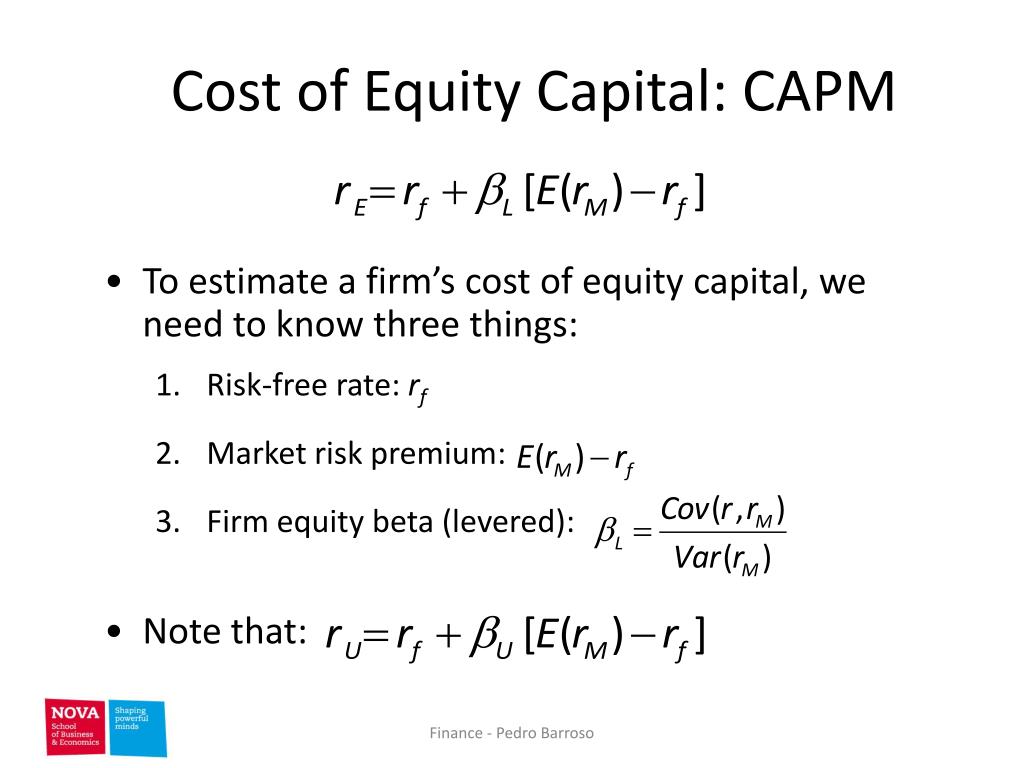

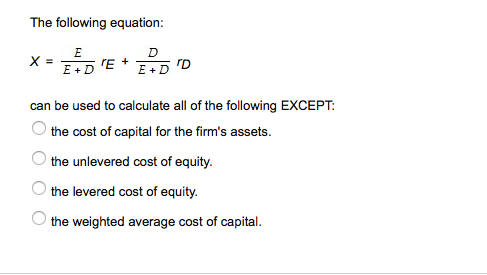

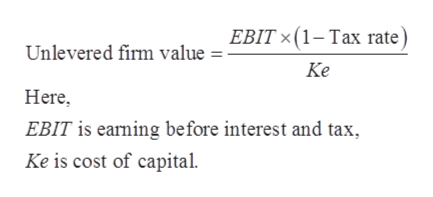

CAPITAL BUDGETING WITH LEVERAGE. Introduction Discuss three approaches to valuing a risky project that uses debt and equity financing. Initial Assumptions. - ppt download

:max_bytes(150000):strip_icc()/COST-OF-CAPITAL-FINAL-fd03399040114d22a1035a573e672ecb.jpg)