Implementing Newton-Raphson method to find strike price in Black-Scholes but the error value keeps increasing? - Mathematics Stack Exchange

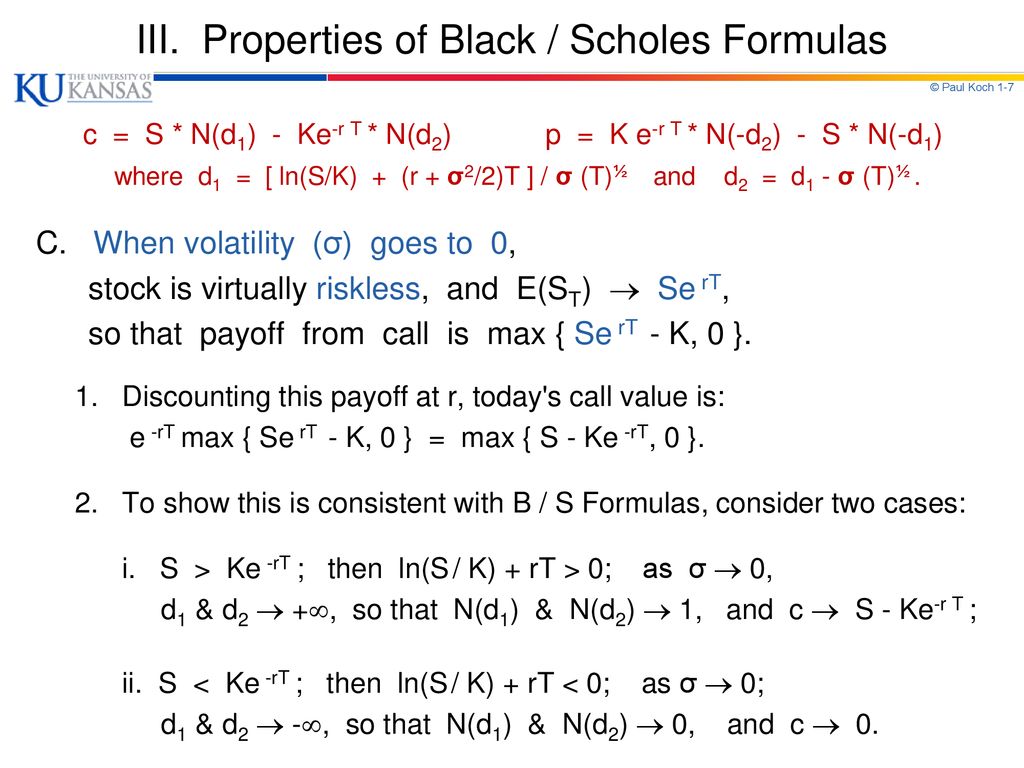

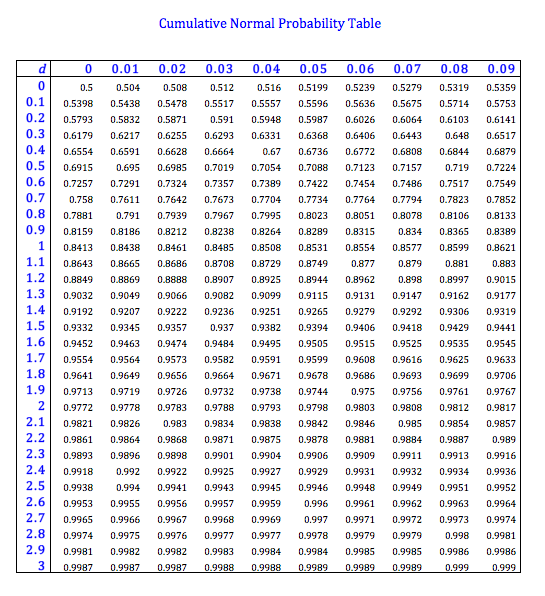

In the black scholes formula how can N(d1) represent the expected return in the event of an exercise and at the same time also mean 'delta' - probability that the option will

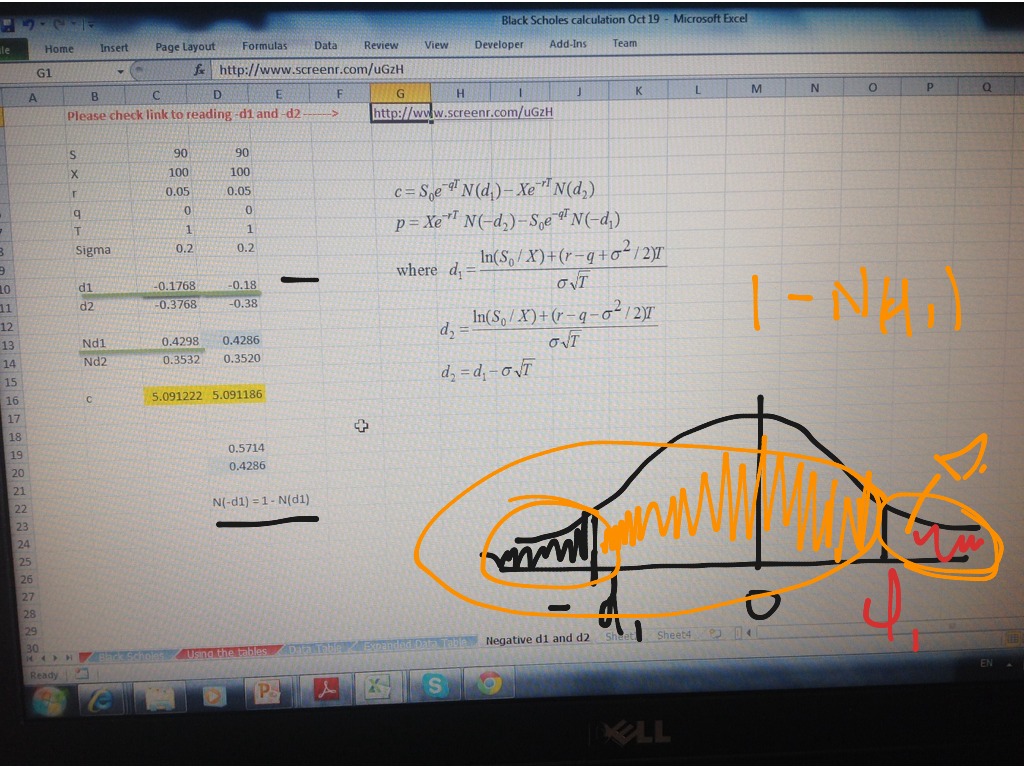

An alternative calculation of the Black Scholes formula for effective hedging programmes - The Global Treasurer

Lecture 12: The Black-Scholes Model Steven Skiena Department of Computer Science State University of New York Stony Brook, NY 11

In the black scholes formula how can N(d1) represent the expected return in the event of an exercise and at the same time also mean 'delta' - probability that the option will

Different approach to Black Scholes model and validation of dynamic delta hedging with Monte Carlo simulation - The Global Treasurer

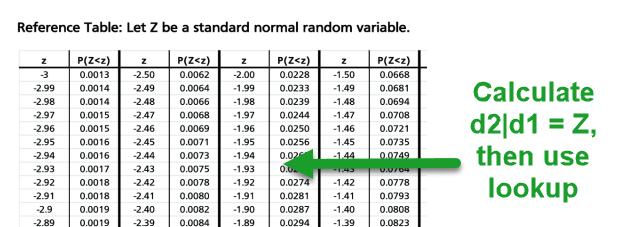

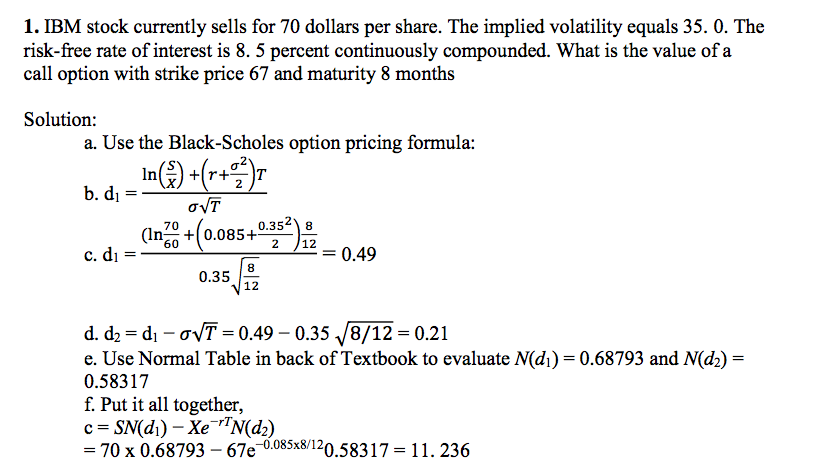

Consider a 1-year option with exercise price $60 on a stock with annual standard deviation 20%. The T-bill - brainly.com